Photo: network Chinese annual over 2000 hours of work experts

Chinese enterprises to invest in overseas frequently, sometimes instead of making foreign Governments doubly wary. This is not, recently dubbed "Chinese buyers in Australia bought a Zhejiang Province" traded by the Australia Government agencies more and more attention.

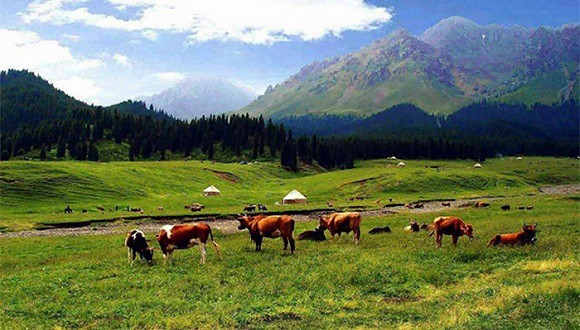

According to the United Kingdom, the Financial Times reported that Chinese buyers are being planned in Australia bid for an area of about 100,000 square kilometers of land, together with nearly 200,000 head of cattle, which include the world's largest cattle farm AnnaCreek. Expect will sell for 325 million Australian dollars (1.51 billion yuan).

According to the Australia broadcasting company (ABC) news, the land's owner, is Australia's largest private "landlords" Kidd Corporation (S. Kidman and Co) said it expected next month, is expected to announce top dogs.

It is understood, there are two groups of Chinese buyers selection, one of the consortium led by Shanghai cred. Another consortium including acquisitions at the ranch had several experiences of Shanghai pengxin group. Is of concern, these companies are private enterprises, and each have experience in participating in overseas acquisitions.

Although it was a good idea, but would still face pressure from all sides to achieve, especially in the area of national security, and Australia were particularly cautious.

Australia Broadcasting Corporation (ABC) said in a report earlier this month, Australia's Defense Ministry said, due to companies in top secret de man Wu Meila (Woomera) missile test base property, any new holder underwent a security assessment.

In addition, despite the distance of hundreds of kilometers with the Kidman family ranch, operated by the US-Australian joint Pine Valley (Pine Gap) defense satellite monitoring base may also complicate the process sold to Chinese buyers.

Although Australia pressure for Chinese buyers, think big, but evidence which is involved in the bid group Chairman Tan Jialong, Director of brand strategy Director said several months ago regarding the plan of the Consortium, also conducted a number of communication between firms, and Ranch prospects after a successful bid.

In his view, the future, in fast-moving consumer goods and food products, Chinese companies need to purchase around the world to meet the needs of its own people, and with several free trade agreements promote as well as national advocacy strategy of going out, increasing overseas investment by Chinese enterprises is the general trend.

The Boston Consulting Group (BCG) report show on September 24, 2014 completed 154 Chinese enterprises overseas merger and acquisition deals, the transaction amount up to us $ 26.1 billion, however, Chinese buyers of overseas mergers and acquisitions transactions completed rate of 67%, far less than Europe, Japan and other developed countries an enterprise level.

Reports also pointed out that with the deepening of China's internationalization process, hoping overseas acquisitions to gain market share and enhancing the core competence of China's enterprises account for a growing proportion.

Luo Ying, one of the authors of the report, the Boston Consulting Group partner, said through overseas merger and acquisition of Chinese enterprises to seek new profit growth point, new markets, and as a leader in global competition. They hope also gets overseas mergers and acquisitions of foreign advanced technologies and valuable experience in brand management and overseas markets, and to hedge against fluctuations in the domestic economy.

No comments:

Post a Comment